Everything you need for the best TikTok ads experience.

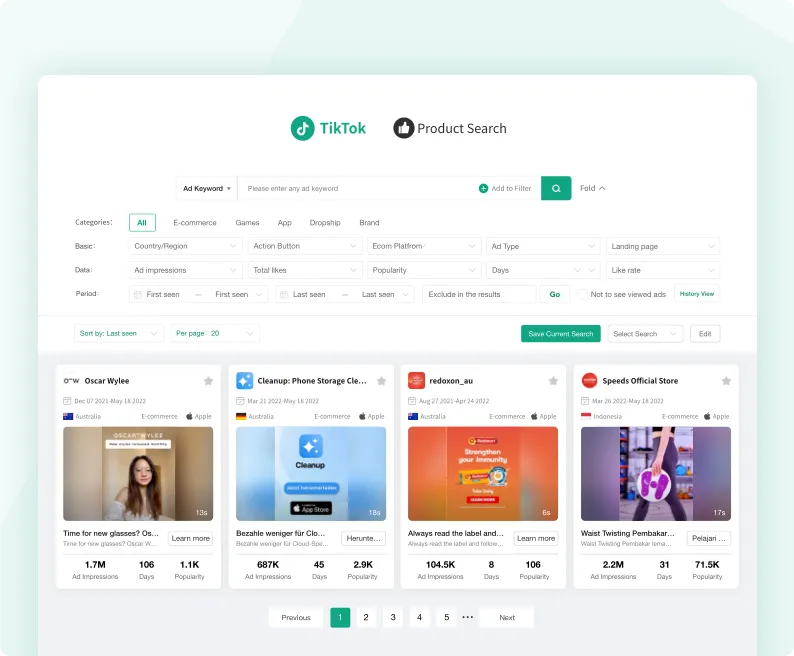

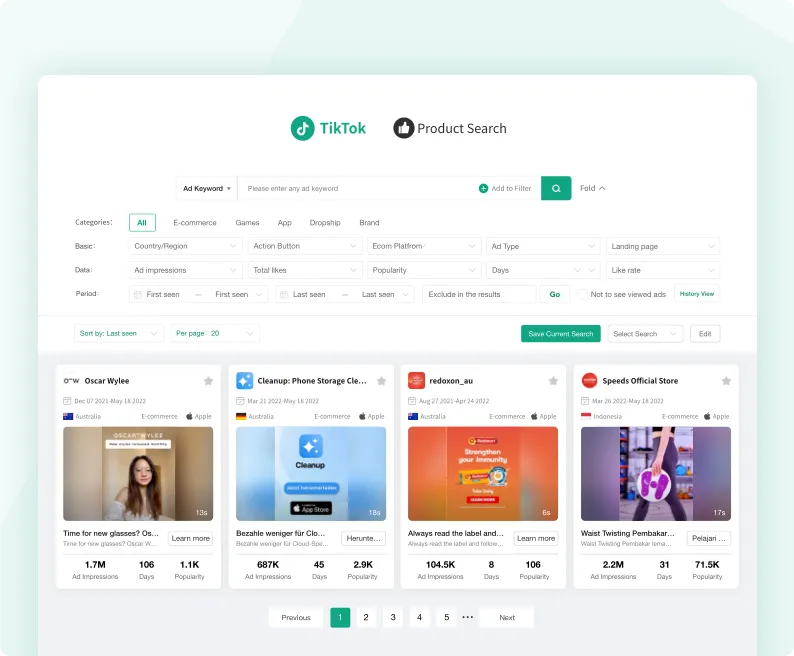

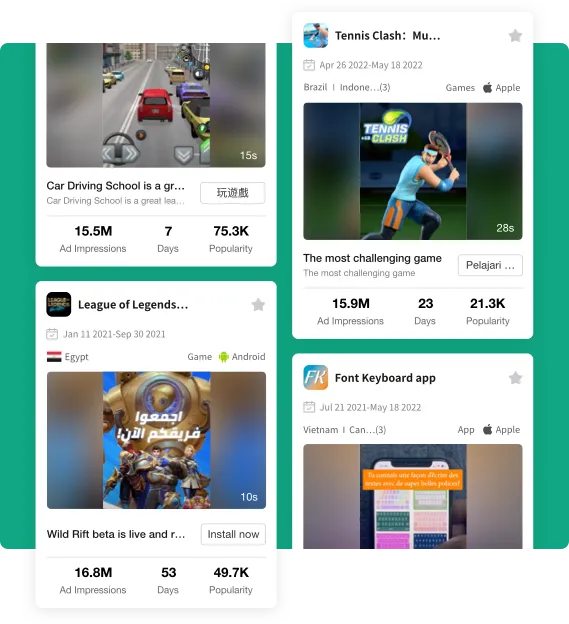

TikTok Ad Library

Find quality ads and products in a library of over 20 million TikTok ads.

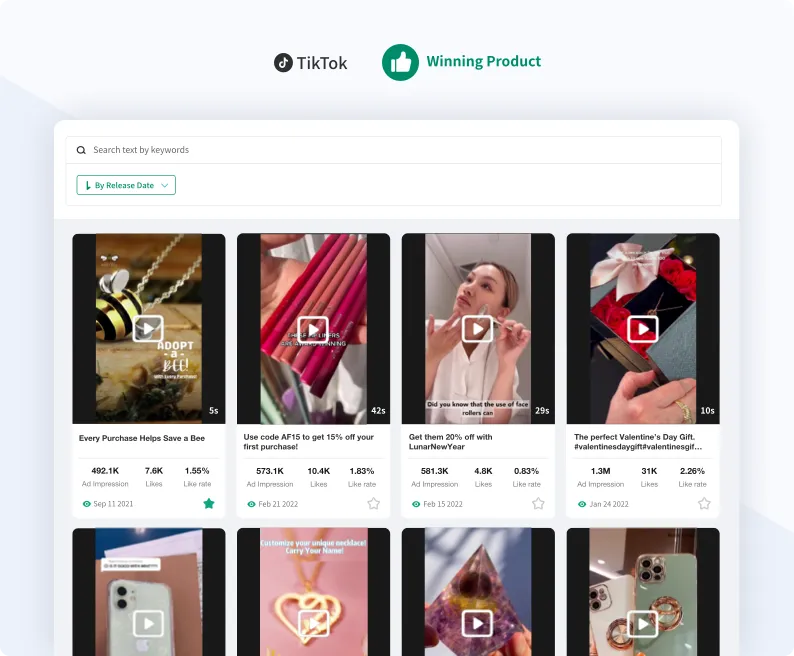

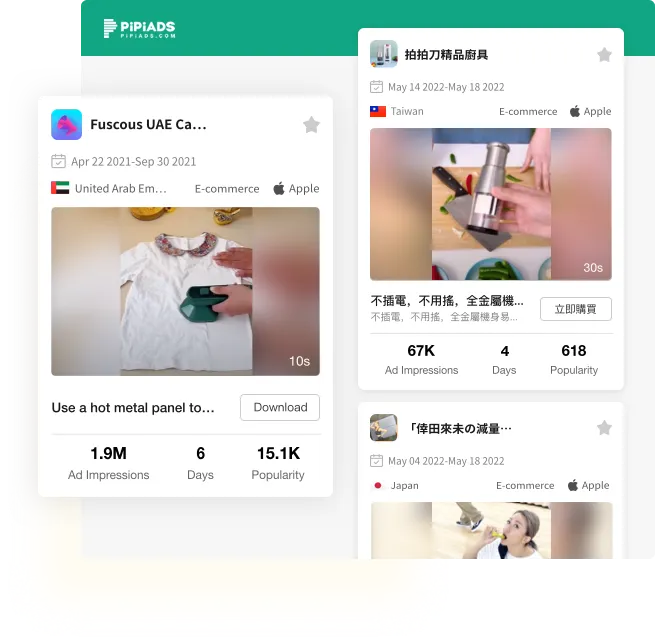

Winning Product

The best new winning products,every day! Find new winners with only a few clicks.

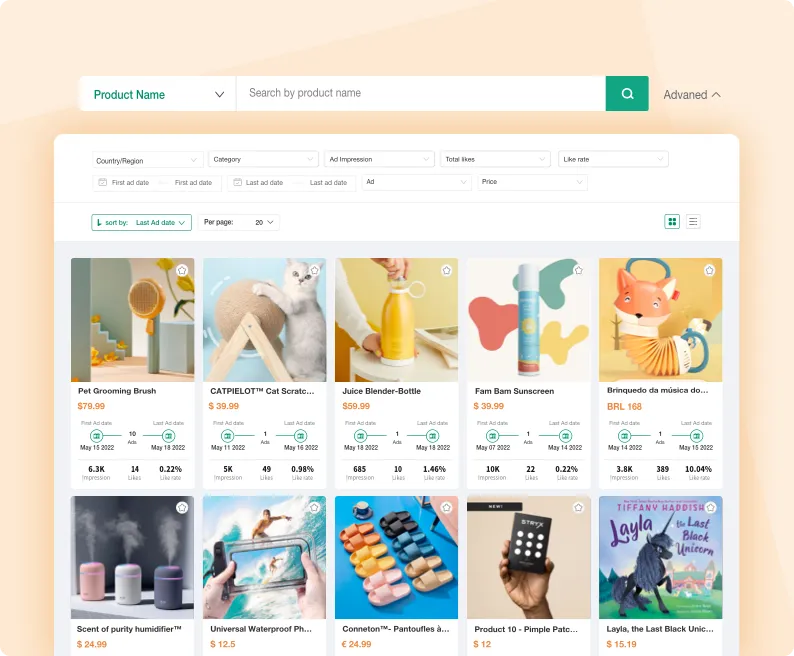

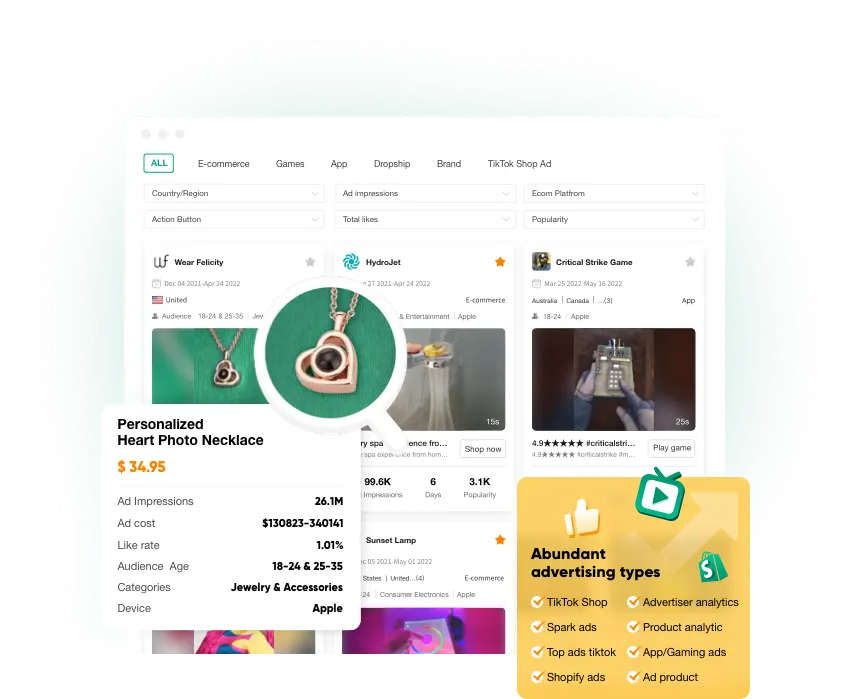

TikTok Ad Product

Find your perfect product. Find winning dropshipping products in minutes.

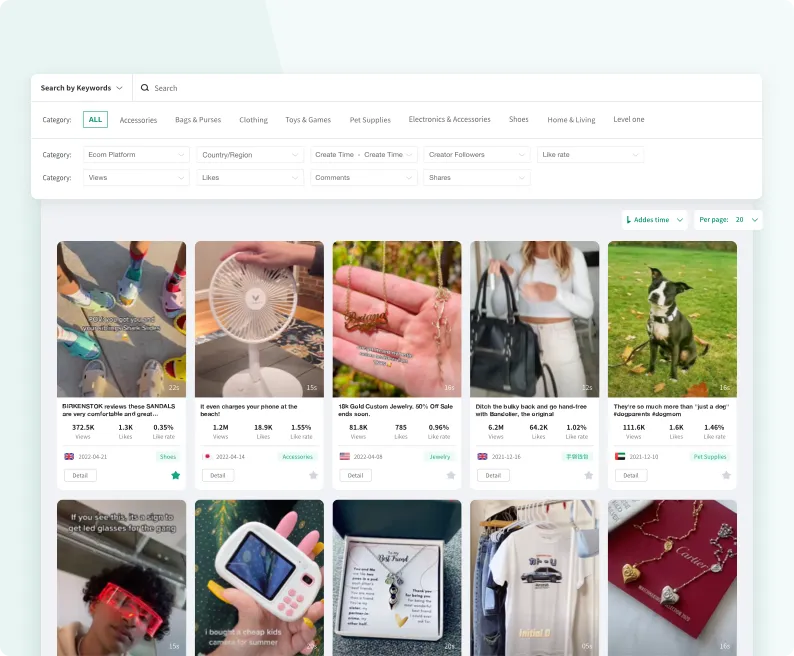

TikTok Trending Products

Stay up to date with TikTok product trends before they go viral,imagine being the first store to sell fidget spinners!

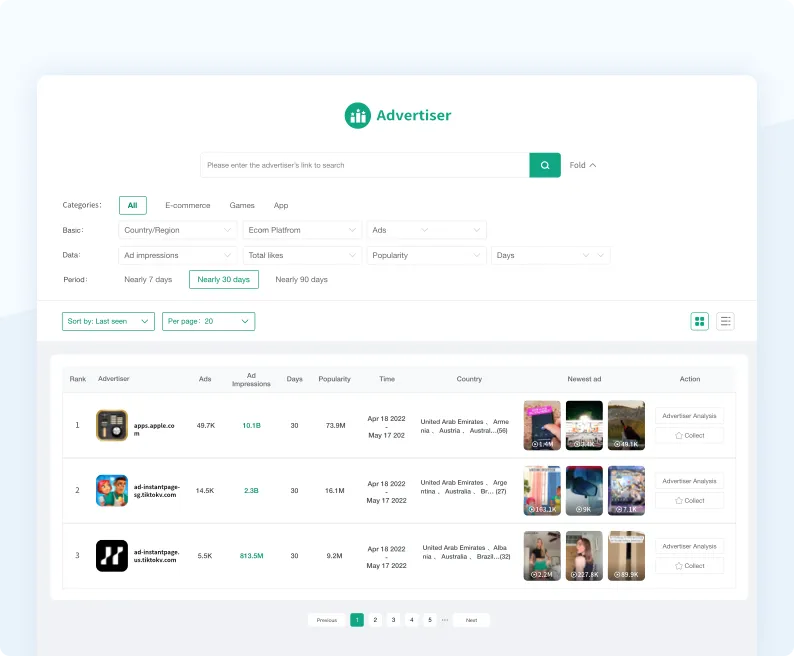

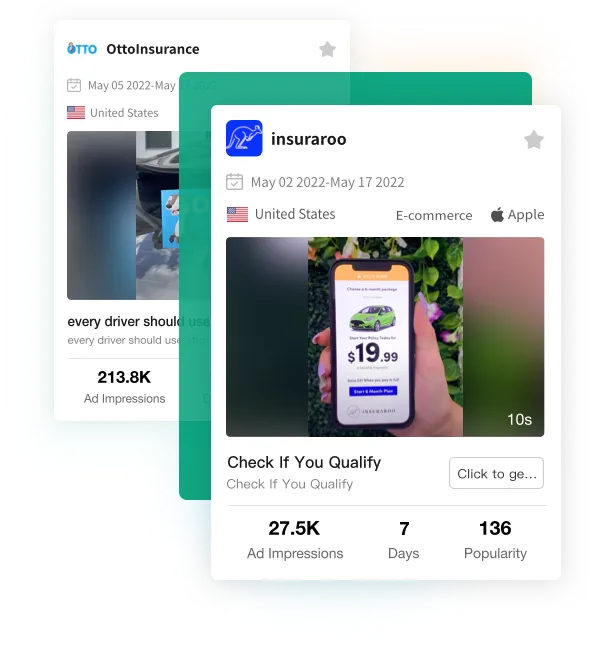

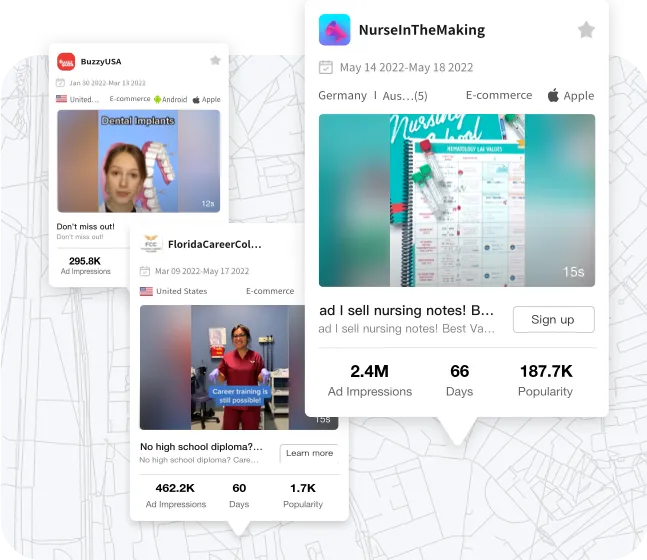

TikTok Advertiser

Discover great advertisers and learn about their well-performing TikTok ads, products, and stores.

What the best of them talk about us

NAZERATI

20.5K on Youtube

DEE DEE Ecom

6.5K on Youtube

Ethan Dobbins

7.4K on Youtube

Sharif Mohsin

98.2K on Youtube

Tomeck

2.8K on Youtube